Car finance can be overcomplicated, we've established that by now, and there are many keywords and phrases you may hear associated with your finance that you need more clarity on.

More than 85% of people with car finance are unsure exactly what everything means and it can sometimes result in people not taking full advantage of their finance terms.

The early settlement figure is something that crops up quite regularly and even though we have created a guide for all of the keywords associated with car finance, it's sometimes better to go into them in more depth to help understand it better.

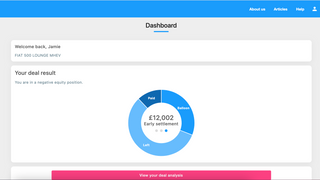

Do you have a car on finance? We can help you understand your car's early settlement figure, as well as its equity position, depreciation value, and much more, with a free appraisal of your deal.

To put it as simply as possible, an early settlement figure is the ability to pay off the remaining balance on a car before the end of the finance agreement.

Anyone can do this, and it can be done by contacting the finance provider and requesting the early settlement - the final figure required to pay off the car.

Once you have paid the early settlement figure, within the timescales provided by the finance company, you will become the outright owner of the car.

You are also entitled to make a partial early settlement which in essence reduces the length of the agreement and/or the monthly payments to be made, depending on how much you paid off.

Why is an early settlement figure?

There are several reasons why someone would want to pay off their early settlement figure. The obvious one is to wipe out future debts, particularly if you've just won or inherited a large sum of money.

Another main reason is that someone would like to sell or change their financed car.

This is where it starts to get a bit tricky as it's not as simple to just add up the remaining monthly figures you owe. However, the finance company will help you understand the true number and where they have accumulated the figures from.

It is very much dependent on what type of finance deal you have on your vehicle. On a Personal Contract Purchase (PCP), you will have the final balloon payment to make at the very least, so adding up your remaining fixed monthly payments would be miles off of what you actually need to pay anyway.

This total may also include other variants, such as excess mileage charges or wear and tear, which would have been agreed upon when you first took out the deal.

Regardless of what type of finance deal you have, though, it will likely include some early repayment charges.

Finance companies make their money off of the interest they add to your repayments, so if you're paying your finance off early, the likelihood is they will make less money from you, which is far from ideal for them.

However, if you're planning on upgrading your car and taking out a new finance deal with them, then they may be happy to waive this figure as they would have secured your custom once more.

So there you have it, that is the early settlement figure explained as simply as possible. We hope it's helped you understand what it means and how it can be of use to you in the future.

If you have a car on finance, you will have an early settlement figure. Car Credible can show you your updated early settlement figure in your very own personalised dashboard.

/early-settlement-figure-finance.jpg)

/carfinancesettlementcalculator.png)

/car-finance-bad-credit.jpg)

/carfinancecompensation.jpg)